Section 179 vehicle calculator

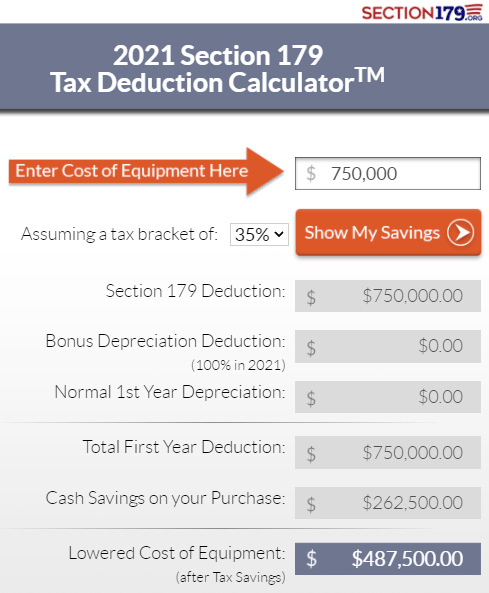

Make your pharmacy more productive profitable when you use this tax benefit with Parata. This Section 179 Deduction Calculator for 2021 may help in your decision.

Section 179 Calculator Ccg

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. The deduction allowance is. The Section 179 deduction generally is barred for vehicles.

2021 SPENDING CAP ON EQUIPMENT PURCHASES IS 2620000. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. This article includes a.

Special rules for heavy SUVs. Limits of Section 179. The calculation is based on the Modified Accelerated Cost Recovery method as described.

Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. You can get section 179 deduction. The changes in the Section 179 Deduction limits for 2021 are drastic and will save your business a lot of money.

Section 179 Deduction Calculator. Section 179 Calculator for 2022. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax.

The benefit of purchasing a heavy vehicle is that the deduction limit for Section 179 is 25000 which is more than double what you can deduct for smaller vehicles. However for those weighing more than 6000 pounds -- many SUVs meet this weight. Ad Browse Our Huge Selection Of Sublimation Blanks Heat Transfer Vinyl Printers.

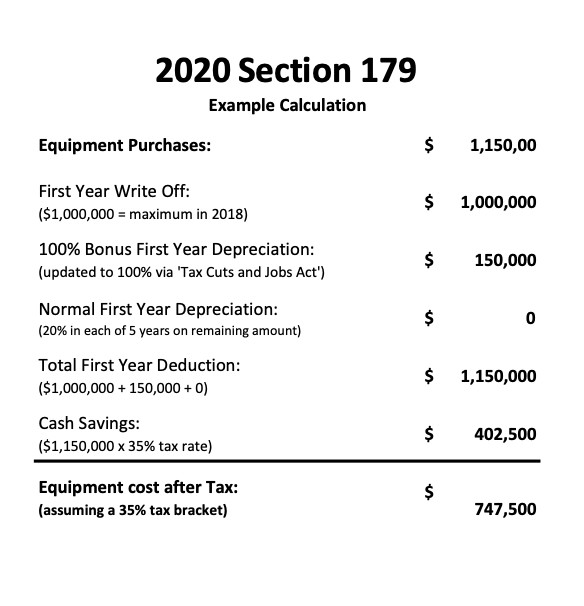

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. This free Section 179 calculator is updated for 2020 go ahead and punch up some numbers to see how much you can save. Section 179 calculator for 2022.

The total amount that can be written off in Year 2020 can not be more than 1040000. Spend up to 2620000 on equipment. Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022.

Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s taxable. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

2020 Section 179 Tax Deduction Calculator TM. Make your pharmacy more productive profitable when you use this tax benefit with Parata. The vehicle must also be used for business at least 50 of the time and these depreciation limits are reduced by the corresponding of personal use if the vehicle is used for business.

This free Section 179 calculator is fully updated for 2019 go ahead run some numbers and see how much you can actually save in real dollars this year. Here is the 2018 Section 179 calculator so you can calculate your 2018 Section 179 deduction for equipment vehicles and software. Now Offering Same Day Shipping.

Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021. Passenger vehicles exceeding 6000 pounds GVW gross vehicle weight will usually qualify but they are typically limited to a 25000 deduction. Lets say you buy a cargo.

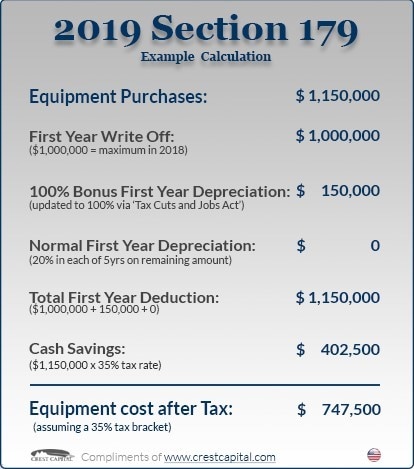

Example Calculation Using the Section 179 Calculator. 2019 Section 179 Tax Deduction. Small vehicles that weigh under 6000 pounds have a Section 179 deduction limit of 10100 in the first year they are used and 18100 with bonus depreciation.

Beyond 262 million the Section 179 Deduction starts to drop dollar for dollar. Companies can deduct the full price of qualified equipment purchases up to. The Section 179 deduction limit for 2022 has been raised to 1080000.

This calculator will calculate the rate and expense amount for personal or real property for a given year. There is also a limit to the total amount of the equipment purchased in one year ie. Typically light vehicles include passenger vehicles cars small and light crossover SUVs and small pickup trucks and small utility trucks.

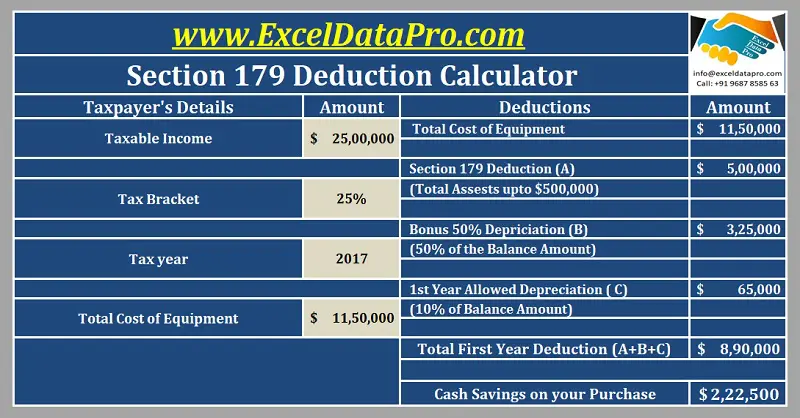

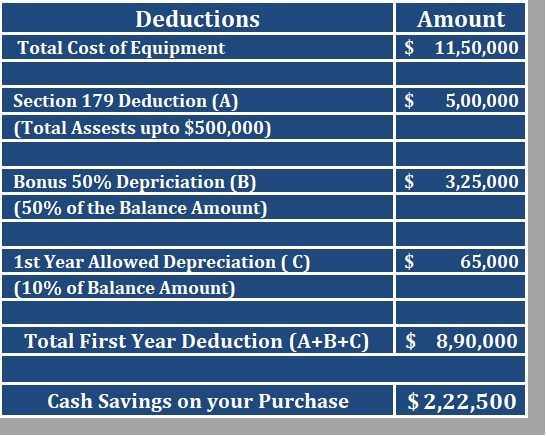

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Deduction Hondru Ford Of Manheim

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

2020 Section 179 Commercial Vehicle Tax Deduction

The Current State Of The Section 179 Tax Deduction

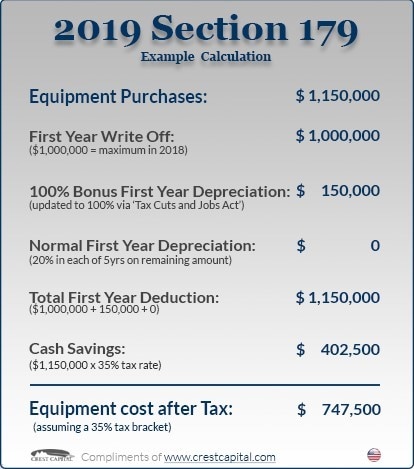

Section 179 Tax Deduction Official 2019 Calculator Crest Capital

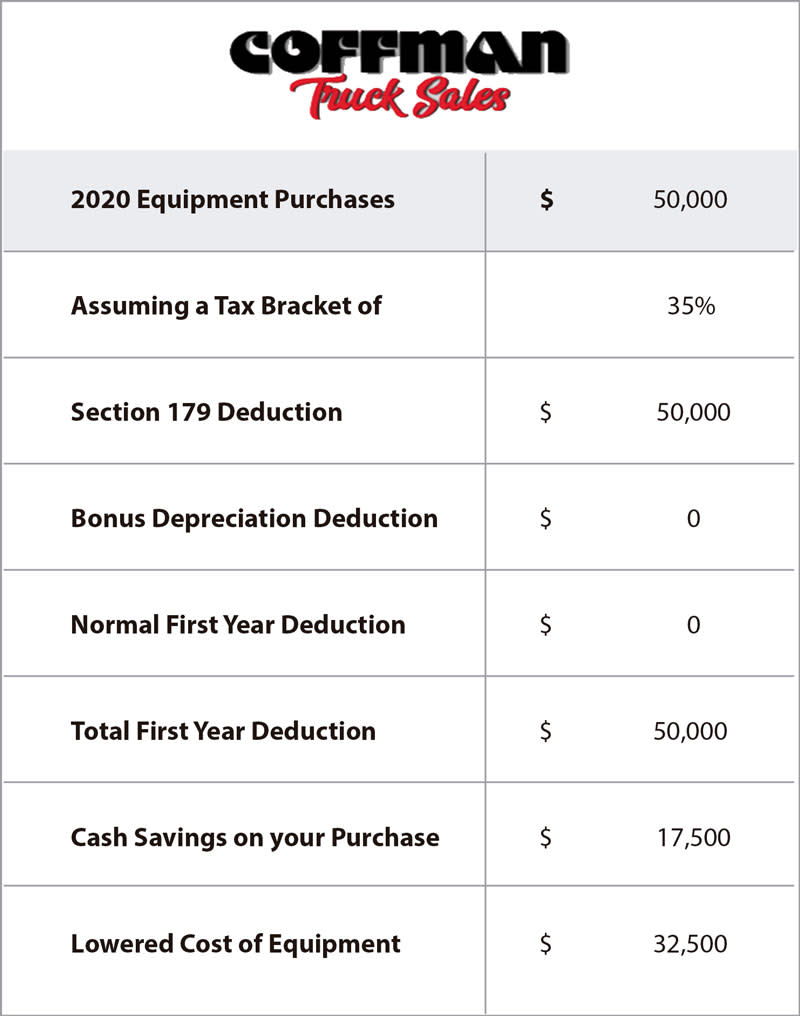

Section 179 Tax Deduction Coffman Truck Sales

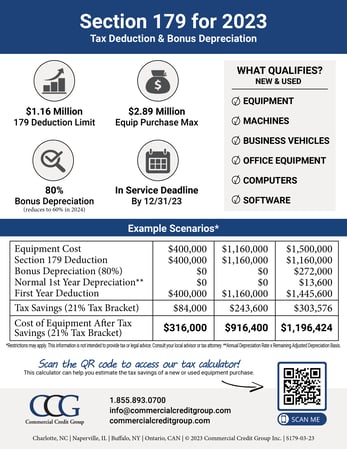

Section 179 Calculator Ccg

Bellamy Strickland Commercial Truck Section 179 Deduction

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Tax Deduction Route 23 Auto Mall

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Download Section 179 Deduction Calculator Excel Template Exceldatapro